Introduction

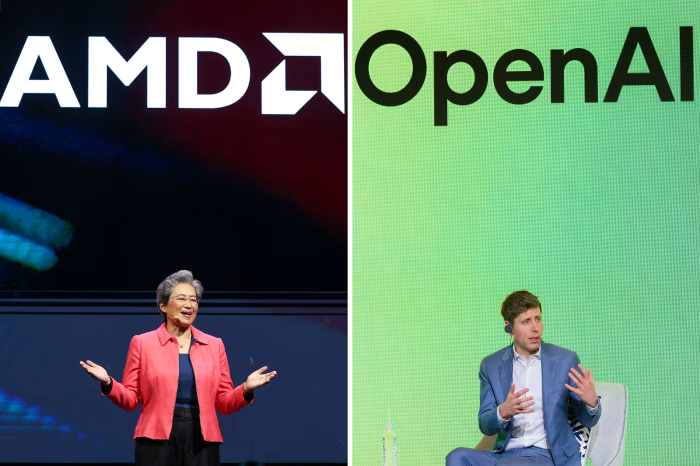

When Lisa Su took the helm of Advanced Micro Devices in 2014, AMD traded on a reputation for graphics cards and PC CPUs. Fast forward to today, and AMD is a cornerstone of the AI hardware supply chain, orchestrating a shift from consumer gaming silicon to data-center accelerators that power large-scale AI workloads. A string of strategic bets—ruthless execution, architectural innovations, and high-value partnerships like an OpenAI deal—have propelled AMD from a niche player to a formidable rival in the AI chip wars.

Key Drivers Behind AMD’s AI Pivot

- Data-center focus over consumer markets: AMD identified higher-margin, higher-growth opportunities in data centers, where AI training and inference workloads require powerful, efficient accelerators.

- Innovative architectures: The company’s GPU and CPU architectures, including multi-die and high-bandwidth memory designs, are optimized for AI workloads and mixed-precision computing.

- Ecosystem and software acceleration: Software stacks, libraries, and toolchains that streamline AI model development help customers deploy AI faster on AMD hardware.

- Strategic partnerships: Collaborations with hyperscalers, cloud providers, and AI researchers broaden AMD’s customer base and validate its chips for production-scale AI.

- Leadership and execution: Lisa Su’s steady leadership, disciplined capital allocation, and a relentless focus on performance per watt have built trust with customers and investors.

The OpenAI Deal: Why It Matters

- Strategic alignment: An agreement with OpenAI ties AMD’s future to the AI model training and inference ecosystem, potentially accelerating the adoption of AMD accelerators in large-language model workloads.

- Validation and credibility: A flagship partnership signals to the market that AMD’s data-center GPUs are battle-tested for cutting-edge AI tasks.

- Revenue and design wins: Partnering with OpenAI can unlock design wins across cloud providers and enterprise customers seeking optimally tuned hardware for AI workloads.

How AMD Built Its AI-Ready Portfolio

- Radeon Instinct and CDNA GPUs: AMD’s AI-optimized accelerators are designed for high-throughput training and efficient inference, addressing the needs of modern AI models.

- CPU-GPU synergy: Ryzen and EPYC CPUs paired with Radeon accelerators deliver scalable, heterogeneous compute platforms that support diverse AI workloads.

- Memory and bandwidth innovations: HBM (high-bandwidth memory) and advanced interconnects reduce data movement bottlenecks, a key constraint in AI systems.

- Datacenter-focused products: Scalable systems aimed at hyperscalers and enterprise data centers help AMD capture a larger slice of the AI infrastructure market.

Market Impact and Competitive Position

- Position against incumbents: AMD competes with the AI GPU leaders by emphasizing total cost of ownership, performance-per-watt, and dense acceleration options.

- Growth leverage: As demand for AI training and inference scales, AMD’s data-center footprints and ecosystem collaborations position the company for sustained growth.

- Investor sentiment: A credible AI strategy backed by major customers and a marquee partnership can support multiple expansions in AMD’s valuation.

Risks to Monitor

- Competitive pressure: Nvidia remains a dominant force in AI GPUs; AMD must continue to differentiate on efficiency, price/performance, and software parity.

- Supply chain and fabrication risk: Foundry capacity, wafer supply, and geopolitical factors can impact ramp timelines.

- Dependency on partners: Relying on major clients or marquee partnerships carries execution and roadmap risk if priorities shift.

What to Watch for Investors and Tech Enthusiasts

- New product announcements: Next-gen data-center accelerators, memory innovations, and software stacks.

- OpenAI collaboration milestones: Scale of deployments, performance benchmarks, and customer wins tied to OpenAI workloads.

- Margin trajectory: How AMD balances R&D, supply chain costs, and pricing to protect profitability as AI adoption grows.

- Ecosystem growth: Adoption by cloud providers, system integrators, and software developers building AI solutions on AMD hardware.

Takeaways

- For developers: Evaluate AMD’s AI ecosystem and toolchains for building and deploying large-scale models, and monitor software updates that optimize performance on AMD hardware.

- For enterprises: Consider total cost of ownership and performance-per-dollar when planning AI infrastructure, including the potential benefits of an OpenAI-aligned accelerator path.

- For investors: Track product roadmaps, data-center wins, and partnership milestones as indicators of AMD’s ongoing AI ramp.

Conclusion

AMD’s journey from a gaming-centric hardware maker to a crucial AI data-center player demonstrates the power of strategic pivots, disciplined execution, and high-stakes partnerships. Under Lisa Su, the company has redefined its trajectory, turning a modest valuation in 2014 into a market-cap milestone and a plausible path toward leadership in AI infrastructure. If you’d like, I can tailor this piece for a specific publication, add data-driven charts or scenarios, or generate multiple SEO variants (titles, meta descriptions, and social snippets) to maximize reach.

FAQs

- Why did AMD pivot to AI-focused data-center chips?

- AI workloads require specialized, high-throughput compute with efficient energy use. AMD aimed to capture a larger share of the growth in AI infrastructure rather than competing only in consumer GPUs.

- How does the OpenAI deal help AMD?

- It validates AMD’s capabilities in real-world, large-scale AI environments and can drive design wins across cloud providers and enterprise customers seeking optimized AI hardware.

- What makes an AI accelerator valuable beyond raw performance?

- Power efficiency, memory bandwidth, software ecosystem, and ease of deployment are critical for total cost of ownership and fast time-to-value.

- Could Nvidia’s dominance limit AMD’s AI ambitions?

- Nvidia is a tough competitor, but AMD can differentiate on efficiency, price/performance, and strategic partnerships, expanding its addressable market.

- What are the biggest risks ahead?

- Execution risk in ramping new products, supply constraints, and reliance on strategic partnerships that could shift with market dynamics.