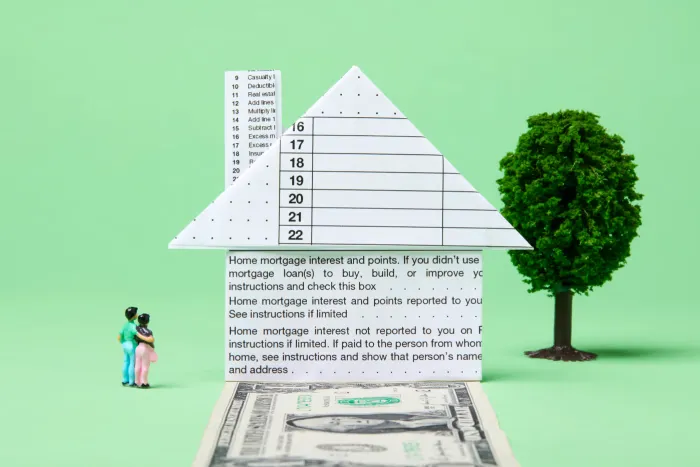

Owning a home isn’t just about having a roof over your head—it can also be a powerful tool for reducing your tax burden. While the upfront costs of homeownership can seem daunting, the financial benefits often extend far beyond the monthly mortgage payments. From deductions to exemptions, your home can serve as a valuable tax shelter, helping you keep more of your hard-earned money. Here’s how :

1. Mortgage Interest Deduction

One of the key tax advantages of owning a home is the deduction for mortgage interest.If you itemize your deductions on your federal tax return, you can deduct the interest paid on your mortgage—up to certain limits. For many homeowners, especially those in the early years of their mortgage when interest payments are highest, this deduction can result in substantial savings.

- Key Details:

- The IRS allows you to deduct interest on mortgage debt up to $750,000 (or $1 million if you purchased your home before December 15, 2017).

- This deduction applies to both primary residences and second homes, provided you meet specific criteria.

2. Property Tax Deduction

Besides mortgage interest, you can deduct the property taxes that you pay on your residence. While recent tax law changes have placed a cap on state and local tax (SALT) deductions at $10,000, this remains a valuable benefit for many homeowners, particularly in areas with high property tax rates.

- Pro Tip: If you’re nearing retirement or planning to relocate, consider consulting a tax advisor to maximize this deduction within the SALT limit.

3. Capital Gains Exclusion

When it comes time to sell your home, the tax code offers another major perk: the capital gains exclusion . If you’ve lived in your home for at least two of the past five years, you can exclude up to $250,000 in profit ($500,000 for married couples filing jointly) from the sale of your primary residence. This exclusion can save you thousands in taxes if your home has appreciated significantly in value.

- Example: Let’s say you bought your home for $300,000 and sold it years later for $700,000. That’s a $400,000 gain. Thanks to the exclusion, a single filer would owe no capital gains tax on the first $250,000 of that profit, while a married couple could shield the entire amount.

4. Home Office Deduction (For Remote Workers)

If you work from home, you may qualify for the home office deduction, which allows you to deduct expenses related to the portion of your home used exclusively for business purposes. This includes utilities, insurance, repairs, and depreciation.

- Two Methods:

- Simplified Method: Deduct $5 per square foot of your home office space (up to 300 square feet).

- Actual Expenses Method: Calculate the percentage of your home used for business and apply it to eligible expenses.

While the Tax Cuts and Jobs Act (TCJA) suspended this deduction for employees through 2025, self-employed individuals and small business owners can still take advantage of it.

5. Energy-Efficient Home Improvements

Investing in energy-efficient upgrades not only reduces your utility bills but can also lower your tax bill. The federal government offers incentives for homeowners who install qualifying energy-efficient systems, such as solar panels, geothermal heat pumps, or energy-efficient windows and doors.

- Current Incentives:

- The Residential Clean Energy Credit allows you to claim 30% of the cost of installing renewable energy systems (like solar panels) through 2032.

- Some states and local governments offer additional rebates or credits for green home improvements.

6. Avoiding PMI Through Strategic Financing

Private Mortgage Insurance (PMI) is typically required if you put down less than 20% on a conventional loan. While PMI itself isn’t tax-deductible (except under specific circumstances), avoiding it altogether can free up cash flow that might otherwise go toward non-deductible expenses. Consider strategies like piggyback loans or saving for a larger down payment to sidestep PMI entirely.

7. Refinancing Opportunities

If interest rates drop or your credit score improves, refinancing your mortgage can reduce your monthly payments—and potentially increase your tax savings. By lowering your interest rate, you’ll pay less in interest over the life of the loan, which translates to smaller deductions but greater overall financial flexibility.

8. Rental Income Offset by Expenses

If you rent out part of your home or own a rental property, you can offset rental income with deductible expenses like maintenance, repairs, insurance, and depreciation. Even short-term rentals (e.g., via Airbnb) may qualify for these deductions, though they come with stricter rules.

- Important Note: Ensure you maintain accurate records of all rental-related expenses to substantiate your claims during tax season.

9. First-Time Homebuyer Credits and Programs

First-time homebuyers may qualify for special tax credits or assistance programs designed to make homeownership more affordable. For example, some states offer mortgage credit certificates (MCCs), which provide a direct dollar-for-dollar reduction in federal income tax liability based on a portion of your mortgage interest payments.

10. Estate Planning Benefits

Your home can also play a role in long-term estate planning. When passing your home to heirs, they may receive a step-up in basis, meaning the property’s value is reassessed at its current market value upon inheritance. This minimizes capital gains taxes if your heirs decide to sell the home later.

Final Thoughts: Maximizing Your Home’s Tax Advantages

While owning a home comes with responsibilities, it also opens the door to numerous tax-saving opportunities. To make the most of these benefits:

- Keep meticulous records of all home-related expenses, including mortgage statements, property tax bills, and receipts for improvements.

- Consult a qualified tax professional to ensure you’re taking full advantage of available deductions and credits.

- Stay informed about changes in tax laws that could impact homeownership benefits.

By leveraging these strategies, your home can do more than provide shelter—it can become a cornerstone of your financial plan, shielding you from unnecessary taxes and helping you build wealth over time.

Key Takeaways:

- Deductions: Mortgage interest, property taxes, and home office expenses can lower taxable income.

- Exclusions: Capital gains exclusions protect profits from home sales.

- Incentives: Energy-efficient upgrades and first-time buyer programs offer additional savings.

- Long-Term Planning: Homes can aid in estate planning and generational wealth transfer.

By : A.Ebeling